About Insurance Account

Wiki Article

Insurance Expense for Beginners

Table of ContentsGet This Report on Insurance QuotesInsurance Account Fundamentals ExplainedInsurance Advisor Fundamentals ExplainedThe Definitive Guide to Insurance CodeGet This Report on InsuranceFacts About Insurance Quotes Revealed

Although buying an insurance coverage that satisfies your state's requirements might allow you to drive without breaking the legislation, low coverage limitations don't supply sufficient defense from an economic perspective. Numerous states just need chauffeurs to have responsibility insurance coverage, as an example. This indicates that in the case of an accident, motorists can incur tens of thousands of bucks of damage that they can't cover on their own, in some cases also leading to monetary ruin.

To save cash, you can select a higher deductible for your crash and detailed coverage. Even though that's a great deal of money to pay in an at-fault crash, it's still much less expensive than changing a person's completed BMW.

Insurance Meaning Fundamentals Explained

Auto Claims Contentment Research, SM. What's more, USAA has a tendency to have the most inexpensive full coverage insurance plan out of every carrier that we reviewed, proving that first-class protection need not come at a costs. Unfortunately, USAA auto insurance policy is just available for military participants as well as their family members, so most vehicle drivers won't be able to capitalize on USAA insurance policy coverage.What type of life insurance is best for you? That depends upon a selection of variables, consisting of exactly how long you desire the policy to last, exactly how much you want to pay as well as whether you intend to make use of the policy as an investment vehicle. Different kinds of life insurance policy, Usual sorts of life insurance policy consist of: Universal life insurance policy.

Guaranteed concern life insurance policy. All types of life insurance fall under two major categories: Term life insurance coverage.

The 15-Second Trick For Insurance Ads

Usual sorts of life insurance coverage policies, Streamlined issue life insurance policy, Ensured issue life insurance policy, Term life insurance policy, How it functions: Term life insurance coverage is usually marketed in lengths of one, 5, 10, 15, 20, 25 or three decades. Insurance coverage amounts differ depending on the policy yet can go right into the millions.

There's typically little to no cash money value within the plan, as well as insurers demand on-time settlements. You can select the age to which you desire the survivor benefit ensured, such as 95 or 100. Pros: Because of the very little cash money worth, it's less costly than whole life and various other forms of global life insurance policy.

The Main Principles Of Insurance Agent

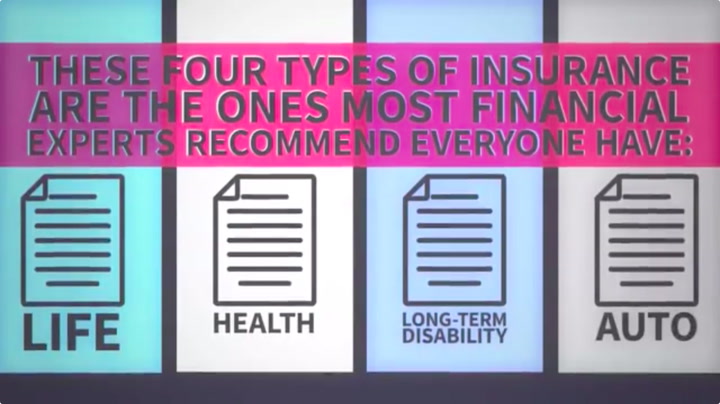

As well as since there's no cash worth in the plan, you 'd walk away with nothing. Indexed global life insurance coverage, Exactly how it functions: Indexed global life insurance policy web links the plan's money value component to a stock exchange index like the S&P 500. Your gains are determined by a formula, which is described in the policy (insurance advisor).Various other kinds of life insurance coverageGroup life insurance is generally provided by companies as part of the firm's work environment benefits. Costs are based upon the group as a whole, instead than each individual. In basic, employers provide look at here fundamental protection free of charge, with the alternative to acquire extra life insurance if you require much more coverage.Mortgage Read Full Report life insurance policy covers the present balance of your home mortgage and also pays out to the lending institution, not your family members, if you die. Second-to-die: Pays after both insurance policy holders pass away. These policies can be made use of to cover inheritance tax or the treatment of a reliant after both policyholders die. Often asked questions, What's the ideal kind of life insurance policy to obtain? The most effective life insurance policy policy for you boils down to your requirements and spending plan. Which types of life insurance coverage deal versatile premiums? With term life insurance as well as entire life insurance policy, premiums commonly are repaired, which implies you'll pay the very same quantity every month. The insurance policy you require at every age varies. Tim Macpherson/Getty Images You need to buy insurance to secure yourself, your household, and also your riches. Insurance policy can conserve you countless helpful resources dollars in the occasion of a mishap, ailment, or calamity. Health insurance as well as vehicle insurance policy are required, while life insurance policy, property owners, occupants, and impairment insurance coverage are motivated. Begin free of charge Insurance isn't one of the most exhilarating to think about, but it's necessary

for shielding yourself, your household, as well as your riches. Mishaps, disease, as well as catastrophes take place constantly. At worst, events like these can dive you into deep economic ruin if you don't have insurance to draw on. And also, as your life adjustments(state, you obtain a brand-new task or have a baby)so ought to your protection.

Examine This Report on Insurance And Investment

Below, we've discussed briefly which insurance protection you should strongly think about purchasing at every stage of life. When you leave the functioning globe around age 65, which is commonly the end of the longest plan you can get. The longer you wait to purchase a plan, the higher the eventual expense.The ideal life insurance coverage policy for you comes down to your demands and also budget plan. With term life insurance and whole life insurance, premiums typically usually fixed, which means suggests'll pay the same exact same every month. Health and wellness insurance coverage and also car insurance are needed, while life insurance policy, property owners, occupants, and impairment insurance policy are encouraged.

Facts About Insurance Asia Awards Revealed

Below, we've described briefly which insurance coverage you ought to strongly take into consideration purchasing every stage of life. Note that while the plans below are set up by age, obviously they aren't ready in rock. Several individuals most likely have short-term impairment through their company, long-lasting impairment insurance is the onethat the majority of people require as well as do not have. When you are injured or unwell and also not able to function, handicap insurance policy supplies you with a percentage of your salary. As soon as you exit the functioning world around age 65, which is frequently completion of the lengthiest plan you can get. The longer you wait to purchase a plan, the higher the eventual cost.Report this wiki page